Non-Profit Insurance 501(c)3

Customized Coverage for 501-c3 Nonprofit OrganizationsAmRisk Nonprofit insurance programs are custom designed for your 501(c)(3) nonprofit organization. The appropriate insurance coverage is essential for your organization to protect against a wide spectrum of risks.

Talk with an expert at 602.702.7600 today

Protecting Non-Profit Organizations Since 1971

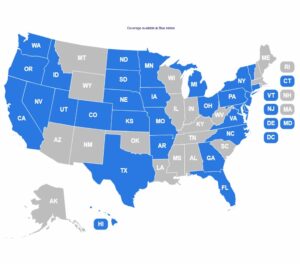

AmRisk Insurance offers comprehensive and equitable coverage through nationally recognized insurance companies. Our policies are specifically designed for every type and size of non-profit.

Premium credit is available if you are a member of an accredited professional association.

Complete Coverage for 501-(c)(3) Non-Profit Organizations

Animal Rescue & Support

Get the right insurance to protect your rescue and support organization

Community Service Programs

Our policy offers coverage to community service organizations including Neighborhood Improvement, Shelter and Social Action programs

Recreational Associations

Choose from our menu of coverage options for complete business protection and peace of mind.

Equestrian Non-Profit Organizations

As a leader in the field of equestrian insurance, we provide unique expertise and access to a wide spectrum of insurance and risk management products throughout the United States

Social & Behavioral Services

We have the experience and specialization to ensure your needs are met with our Human Services Insurance and Social Services Insurance plans

Veterans Organizations

Life after military service can present challenges Veteran Service Organizations (VSO) can help service members before, during and after the transition process.

Start The Process... Getting A Quote

Our policies are specifically designed for every type of 501-c3 Non-Profit Organization. We employ a data gathering and application process to guarantee you the appropriate coverage and best possible premium. Please use the button below to request a quote and talk to an expert.

Coverage Options For Non-Profit Organizations

General Liability Insurance

A Commercial General Liability Insurance policy pays the damages for liability imposed upon you or your business by the law. It also pays the cost of defending you when a claim is made against your policy.

Directors & Officers

Errors & Omissions

D&O insurance for nonprofits protects directors, officers, and board members against legal expenses if they are sued for a decision they made on behalf of the company that led to financial loss.

Professional Liability Insurance

Professional liability insurance for nonprofits is also called errors and omissions insurance (E&O). It covers legal expenses when an oversight or mistake leads to a lawsuit.

Property Insurance

Having the right commercial property coverage could mean the difference between a minor disruption to operations and a major financial loss. Business property insurance can protect your company’s physical assets from unexpected events, including fires, windstorms, theft and vandalism. Physical assets covered by commercial property coverage could include the business property you own or rent, office equipment, furniture, fixtures, inventory and other items you count on to support your daily operations.

Cyber Liability Insurance

Cyber liability insurance is an insurance policy that provides businesses with a combination of coverage options to help protect the company from data breaches and other cyber security issues. It’s not a question of if your organization will suffer a breach, but when. AmRisk’s cyber insurance policyholders can also access tools and resources to manage and mitigate cyber risk — pre-breach and post-breach.

Improper Sexual Contact & Physical Abuse

It is important coverage for nonprofits if there is any opportunity for staff, management, board members, or volunteers to be in unsupervised contact with clients or members of the public, particularly vulnerable populations such as children, people with disabilities, or the elderly.

This policy should also pay for the cost of defense and any indemnity payment relative to these types of allegations.

Liquor Liability Insurance

Liquor liability coverage helps protect businesses from claims of bodily injury or property damage if they sell, make or serve alcohol. You can add this coverage as an endorsement on your general liability insurance policy. Host liquor liability coverage helps protect companies that don’t sell alcohol but allow people to drink it on their business property. Host liquor liability coverage may be excluded in a general liability policy. It’s a good idea to have liquor liability insurance if your business holds special events where liquor is served or consumed

Business Automobile Insurance

Also known as commercial auto coverage, this includes coverage for auto liability and/or auto physical damage for autos the organization owns or leases. Commercial auto coverage should cover drivers acting in their capacities as employees or volunteers.

Non-owned and hired auto is liability insurance in addition to the owner or operator’s personal auto policy for bodily injury and property damage caused by a hired vehicle (including rented or borrowed vehicles) or by vehicles owned by others providing services on behalf of the nonprofit (including your employees’ or volunteers’ vehicles). This is not protection for the individual driver. It is coverage for the organization should the organization be sued for damage.

Participant / Volunteer Accident Insurance

Worker’s Compensation

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Who Can We Insure?

Who Can We Insure?

Our program writes coverage exclusively for 501(c)(3) organizations of all sizes.

They include but are not limited to:

- Art and Education

- Animal and Environmental

- Community & Civic Associations

- Equine Assisted Learning & Psychotherapy

- Equine Rescue & Management

- Mental Health and Developmental Disabilities

- Human & Social Services

- Neighborhood Improvement and Social Action

- Professional Non-profit Associations

- Recreation Clubs & Associations

- Shelter, Nutrition, and Employment

- Philanthropy, Volunteerism, and Grantmaking

- New 501(c)(3) organizations

- … and many more.

By understanding the unique operations of your nonprofit, we can offer you fair and equitable premiums.

Our insurance premiums are based on your organization’s specific level of risk — not on the whims of the insurance market.

The money your nonprofit saves can be put to better use toward your mission and community!

Who can’t we insure in this program?

We cannot insure Nonprofit organization types other than 501(c)(3), such as 501(c)(4), 501(c)(6), etc. in this policy.

Please contact us to discuss other markets available.

Ineligible Classifications:

- Athletic leagues

- Boy Scouts / Girl Scouts troops

- Chambers of commerce, trade associations, or homeowners’ associations

- Churches, or organizations whose main goal is to promote the specific teachings or beliefs of a specific religion or person

- Detox facilities, hospitals, blood banks, or birth centers

- Equestrian Organizations with extensive mounted activity (other than EAT)

- Fairgrounds

- Lockdown facilities, or facilities that hold people against their will

- Mountain bike / Motocross groups

- Nonprofit developers that build with the intent to sell

- Universities

- Zoos

We can consider 501(c)(3) nonprofits that are only affiliated with the types of organizations above.

Examples of affiliated organizations: Food banks / pantries / thrift stores connected to churches, foundations that benefit zoos, or supporting organizations.

Our Non-Profit Clients also get risk management services!

Many nonprofits pay a lot of money for risk management services. If your non-profit is insured by AmRisk, you get all of the risk management services below for free — or at a highly-discounted rate.

Consulting services.

Risk management consulting services to help your nonprofit identify and mitigate key risks across your organization. Whether you are looking for general loss control or something more specialized, the AmRisk team offers personalized assistance to support you through customized risk management solutions. Managing risk should not be a burden. Let us help you do what you do best — stay focused on your mission.

Webinars

Discover risk management strategies, exclusive AmRisk client resources, and learn how new regulations and laws may affect your nonprofit.

Risk Management Plan

Online tools to help you create a risk management plan that reflects your organization’s unique needs, priorities, and culture.

Online board tool

Help your nonprofit’s board function more efficiently and effectively with BOARDnetWORK, an easy-to-use, web-based communication tool.

E-books on risk management for nonprofits.

Expert advice to help nonprofits in non-technical, easy-to-understand language, with case studies and sample forms.

Contact Us Today!

PO Box 6230

Scottsdale, AZ 85261

ballen@amriskusa.com